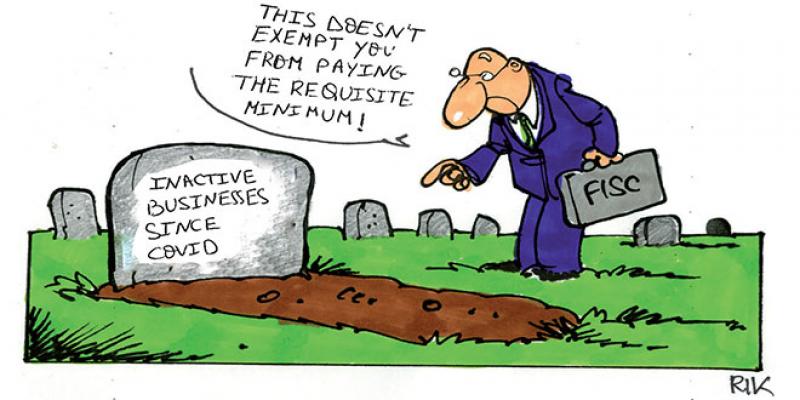

VAT-liable or VAT-exempt entities All under scrutiny!

Entities not subject to VAT or exempt from VAT without the right to a tax deduction will henceforth be under the watchful eye of the tax authorities. The Finance Bill, which has just passed its second reading in the House of Representatives, introduces a new, particularly strict value-added tax reversal liability system which applies to purchases made by VAT-registered companies from suppliers who are either outside the scope of the tax or exempt without the right to deduction, and who consequently issue invoices without including VAT.