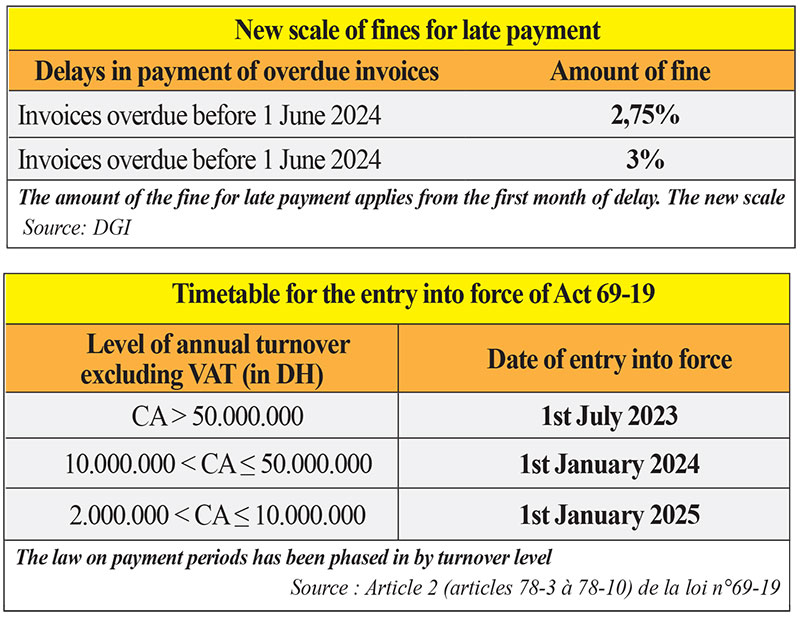

The scale of fines applicable to invoices paid late has changed. It has been reduced from 3% to 2.75% following the cut in Bank Al Maghrib’s (BAM) key interest rate, decided by its Board of Directors on June 25 with an effective date of June 27. The change involves not only a reduction in the amount of the current fine, but also the determination of the terms and conditions for applying the new scale. After studying the implications of this change from every angle, the Directorate General of Taxes (DGI), which manages the payment terms system from start to finish, has taken a definitive position. Thus, invoices for which the late payment period began on or after June 1 will be subject to a 2.75% fine for the first month of delay. On the other hand, the scale remains unchanged for invoices overdue before June 1, i.e. a scale of 3%. A press release was to be issued on Monday July 1, given the importance of the issue of payment deadlines and the upcoming deadline for the second quarter 2024 tax return, which runs from July 1 to the end of this month (Article 78-4).

DGI technicians had to work over the weekend to parameterize the Simpl platform to take account of the change in the fine scale for late payment. The aim was to update the portal as of Monday July 1, and enable the taxpayers concerned to file their returns in accordance with the new rules. The tax authorities have set up an e-mail address for taxpayers and have mobilized the call center for any requests for assistance.

The reduction in the amount of the fine is a consequence of the reduction in the central bank’s key rate. Indeed, according to article 78-3 of Law No. 69-21 relating to payment terms, BAM’s key rate determines the rate of the fine payable to the Treasury, applicable to invoices paid late in relation to the agreed deadlines. As a result, the new fine rate has been reduced to 2.75%, applied to the first month of late payment, increased by 0.85% for each month or fraction of a month of delay. The amount of the surcharge remains unchanged. The total is applied to the amount of each invoice, including all taxes, not paid within the legal time limit. Article 78-3, which deals with the fine, does not specify how it is to be applied in the event of an upward or downward revision of the key rate. This is the first time that the amount of the fine has been revised downwards since the law came into force in July 2023.

Bad payers will once again have the upper hand. In fact, they will be the big winners in the downward revision of the penalties scale for invoices overdue after June 1, which will be subject to a fine of 2.75% instead of 3%. That is a gain of 25 basis points. They certainly won’t be rushing to pay their debts on time.

Hassan EL ARIF